In this tax season 2024, the IRS sets deadlines for taxpayers to pay their taxes, including estimated tax payments not subject to withholding. The first quarter estimated tax payment deadline for 2024 is April 15. This blog delves into the details of this deadline, its significance, who it affects, why it exists, penalties for non-compliance, exemptions, tools for estimation, required forms, and IRS support.

When is the Deadline?

April 15 is the deadline for tax season 2024 to submit first quarter estimated tax payments to the IRS. This deadline is crucial for individuals and businesses with income sources that do not have taxes withheld, such as self-employment income, interest, dividends, and rental income.

Who Needs to File?

This deadline primarily affects self-employed individuals, freelancers, independent contractors, sole proprietors, partners in partnerships, and shareholders in S corporations. It also includes individuals who receive income from sources where taxes are not automatically withheld.

Reason for Quarterly Payments

Taxpayers are required to make estimated tax payments quarterly because of the pay-as-you-go system in the U.S. tax system. This system ensures that taxes on income earned during the year are paid throughout the year, rather than waiting until the following year. This helps in avoiding large tax bills at the end of the year and ensures a steady flow of revenue for the government.

Types of Income

When estimating quarterly tax payments, taxpayers need to ensure they include all forms of earned income, encompassing regular employment income, part-time work or side jobs, earnings from selling goods or services (typically reported on Form 1099-K), and various other sources like interest, dividends, capital gains, alimony, and rental income. It’s crucial to incorporate all income, including those not subject to withholding, to accurately calculate and fulfill tax obligations, thereby avoiding penalties or underpayment issues.

Penalties for Late Filing

Failure to file estimated tax payments by April 15 can result in penalties. The penalty amount varies depending on factors like the amount of tax owed and the duration of the delay. Taxpayers can use IRS penalty calculators or consult IRS publications to understand the potential penalties they might face.

Estimation and Required Documentation

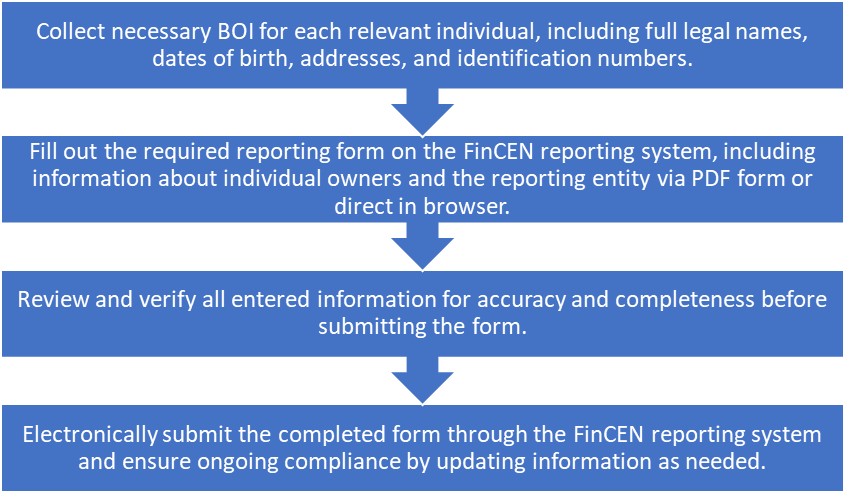

To report and pay estimated taxes, individuals and businesses to file Form 1040-ES. This form includes worksheets for calculating the estimated tax amount and payment vouchers for submitting payments to the IRS. Additionally, there are online calculators and tax preparation software that can assist in accurately estimating tax liabilities based on income and deductions. It is also advisable to engage certified tax professionals to avoid any tax disputes, penalties, or IRS audits in the future.

Exemptions and Due Date Extensions

Certain groups of taxpayers, including farmers and fishers, recent retirees, individuals with disabilities, those receiving irregular income and victims of disasters are eligible for exceptions to penalties and special regulations.

Following recent disasters, eligible taxpayers in Tennessee, Connecticut, West Virginia, Michigan, California, and Washington have an extended deadline for tax season 2024 for estimated tax payments until June 17, 2024. Similarly, eligible taxpayers in Alaska, Maine and Rhode Island have until July 15, 2024, and eligible taxpayers in Hawaii have until Aug. 7, 2024. For more information, visit Tax Relief in disaster situations.

In addition, taxpayers who live or have a business in Israel, Gaza, or the West Bank, and certain other taxpayers affected by the terrorist attacks in the State of Israel, have until Oct. 7, 2024, to make estimated tax payments.

IRS Support and Assistance

The IRS provides various resources and support for taxpayers regarding estimated tax payments. This includes to include the Interactive Tax Assistant, tax topics and frequently asked questions, and assistance through phone or in-person support at IRS offices or tax assistance centers.

IRS AUDIT GROUP

IRS Audit Group consists of tax professionals, CPAs, enrolled agents, and tax attorneys. We are located in Los Angeles; California and our primary area of expertise is IRS Tax Audit Representation. However, our certified professionals cooperate and work with all IRS offices across the country. Please contact us for more information. https://irsauditgroup.com/contact/

Telephone Number: (310) 498-7508

info@irs-audit-group.com