What is the Corporate Transparency Act?

The Corporate Transparency Act (CTA) was enacted by Congress as part of the National Defense Authorization Act (NDAA) for Fiscal Year 2021 to combat financial crimes, including money laundering, terrorist financing, and other illicit activities facilitated by anonymous shell companies. The CTA’s reporting requirements will come into effect on tax season 2024 starting from January 1, 2024.

One of the key provisions of the CTA is the requirement for certain types of businesses to disclose their beneficial ownership information (BOI) to the Financial Crimes Enforcement Network (FinCEN). Beneficial owners refer to individuals who have a significant portion of a company’s equity or voting rights. In the past, it was relatively easy for individuals to establish shell companies without revealing their true ownership, enabling illicit actors to engage in financial activities anonymously. The CTA addresses this issue by mandating businesses to provide comprehensive information about their beneficial owners, including their full legal names, dates of birth, current addresses, and unique identification numbers. This information is stored in a confidential FinCEN database accessible to authorized government agencies, law enforcement, and financial institutions conducting due diligence. BOI reporting is not an annual requirement unless a company needs to update or correct information, a report only needs to be submitted once.

Who has to file for BOI?

Entities obligated to disclose information are referred to as reporting companies, and they come in two distinct categories:

Domestic Reporting Companies: Domestic reporting companies encompass corporations, limited liability companies, and other entities established through the submission of documents to a secretary of state or a similar office within the United States. These entities are formed and operate within the legal framework of the United States.

Foreign Reporting Companies: Foreign reporting companies are entities, such as corporations and limited liability companies, constituted under the laws of a foreign country. However, they have elected to conduct business in the United States by formally registering through the submission of relevant documentation to a secretary of state or a comparable office. This registration signifies their commitment to complying with reporting requirements in the U.S., ensuring transparency and regulatory adherence in their operations.

There are exemptions to the reporting requirements of the BOI for certain entities which are categorized into 23 types. These exemptions include publicly traded companies, certain financial institutions regulated by federal or state agencies, and entities that demonstrate low risk for money laundering or terrorist financing based on specific criteria. It is important to find out whether your company is eligible for exemption through the small entity compliance guide provided by FinCEN.

Key Reporting Requirements for Tax Season 2024

A reporting company will have to report the following as stated by FinCEN:

- Its legal name;

- Any trade names, “doing business as” (d/b/a), or “trading as” (t/a) names;

- The current street address of its principal place of business if that address is in the United States (for example, a U.S. reporting company’s headquarters), or, for reporting companies whose principal place of business is outside the United States, the current address from which the company conducts business in the United States (for example, a foreign reporting company’s U.S. headquarters);

- Its jurisdiction of formation or registration; and

- Its Taxpayer Identification Number (or, if a foreign reporting company has not been issued a TIN, a tax identification number issued by a foreign jurisdiction and the name of the jurisdiction).

A reporting company will also have to indicate whether it is filing an initial report, a correction, or an update of a prior report.

For each individual who is a beneficial owner, a reporting company will have to provide:

- The individual’s name;

- Date of birth;

- Residential address; and

- An identifying number from an acceptable identification document such as a passport or U.S. driver’s license, and the name of the issuing state or jurisdiction of the identification document (for examples of acceptable identification, see Question F.5).

The reporting company will also have to report an image of the identification document used to obtain the identifying number in item 4.

Reporting Process

The reporting companies can file electronically through a secure filing system available via FinCEN’s BOI E-Filing website. The E-Filing portal permits a reporting company to choose one of the following filing methods to submit a BOI:

- Upload the finalized PDF version of the BOI report and submit it online.

- Fill out a Web-based version of the BOI report and submit it online.

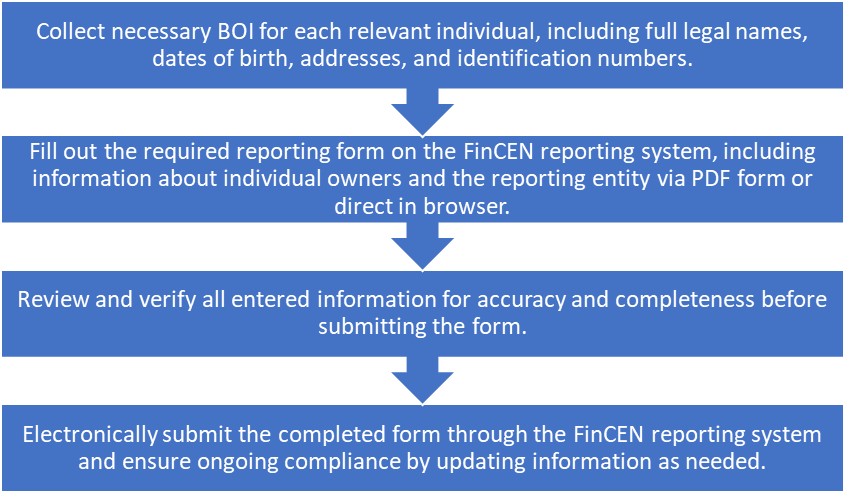

A reporting company may submit its BOI report through either of these methods, both of which require the filing to be done online as BOIRs cannot be mailed or faxed to FinCEN. Step-by-Step process is defined in the below image.

FinCEN expects that reporting companies can file by themselves through guidance given on the official website. However, reporting companies that need help meeting their reporting obligations can consult with tax professional service providers such as tax lawyers or accountants.

Deadlines for BOI Filing

- A reporting company established or registered for business activities before January 1, 2024, is granted until January 1, 2025, to submit its initial BOI report.

- In the case of a reporting company created or registered in 2024, the timeline for filing extends to 90 calendar days from the point of receiving actual or public notice confirming the effectiveness of its creation or registration.

- For reporting companies formed or registered on or after January 1, 2025, the window for filing the initial BOI report is condensed to 30 calendar days from the receipt of actual or public notice affirming the effectiveness of the company’s creation or registration.

Penalties for Non-compliance to CTA

Within 90 days of the original report deadline, the reporting companies must correct a mistake or inaccuracy or submit reports to avoid penalties. However, failure to comply with BOI reporting obligations may result in civil and criminal repercussions. Under the CTA, intentional violations of BOI reporting requirements can lead to civil penalties of up to $500 for each day of non-compliance. Additionally, individuals may face criminal penalties, including imprisonment for up to two years and a fine of up to $10,000.

Potential violations may include intentionally neglecting to submit a BOI report, knowingly submitting a false BOI, or purposefully neglecting to correct or update previously reported BOI. It is crucial to adhere to reporting obligations and promptly rectify any errors to avoid potential legal consequences outlined by the CTA.

IRS Audit Group

IRS Audit Group comprises tax professionals, CPAs, enrolled agents, and attorneys. We are located in Los Angeles; California and our primary area of expertise is IRS Tax Audit Representation. However, our certified professionals cooperate and work with all IRS offices across the country. Please contact us for more information. https://irsauditgroup.com/contact/

Toll Free: (888) 300-6670

Emergency Number: (310) 498-7508