Business Taxes:

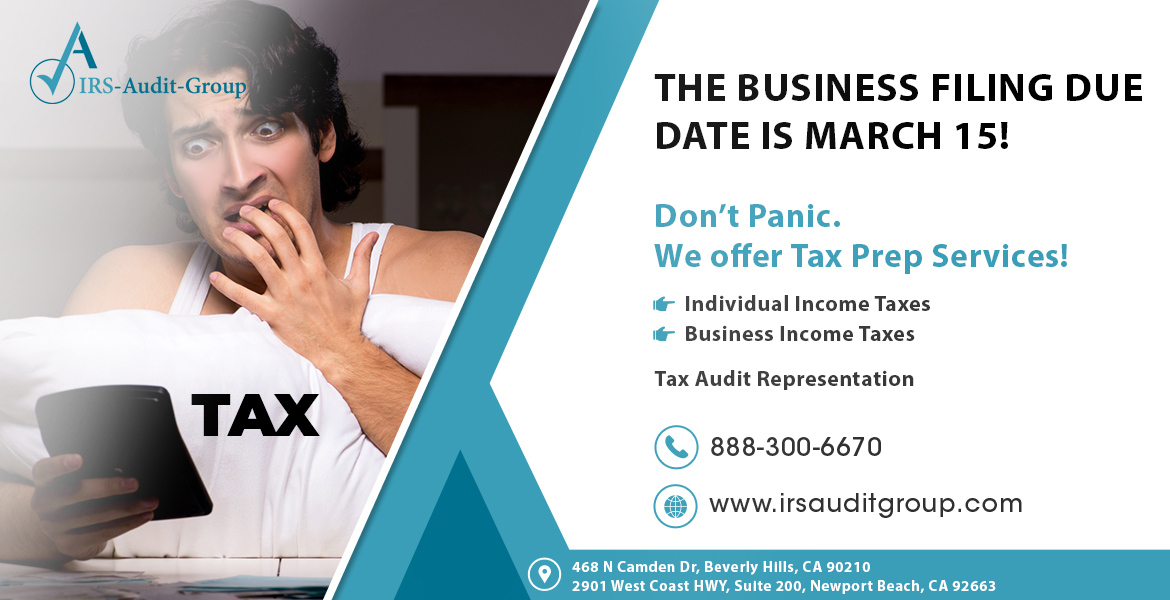

Business Filing Due Date – March 15

Filing taxes is an important part of running a business! The filing due date for businesses differs from the dates for individuals! The due date to file taxes for an S Corporation, LLC or a Partnership is 03-15. If you need a tax extension, the date for tax extensions is also on March 15th. IRS Audit Group will help you file your business taxes, and even your individual taxes. We can explain the tax filing processes to taxpayers and businesses owners. With a quick phone call, you can understand how filing taxes can affect your business and the importance of filing business taxes on time.

Tips

Income Tax:

All businesses must file a yearly income tax return. Federal income tax is pay as you go. If an employee does not have money deducted from each paycheck, they may have an estimated tax.

Estimated Tax:

If a business is expected to owe a tax of $1,000 ($500 for corporations) or more when they file their return, they usually might have to make estimated tax payments. We can help you figure out what your estimated taxes are.

Self Employment Tax:

Self Employment tax is generally a social security or medicare tax for individuals who work for themselves. If your net earnings were $400 or more, you must pay self employment taxes.

Employment Tax:

If you have employees, there are certain tax related documents that you must file with the IRS.

IRS Audit Group

Why Choose Us:

IRS Audit Group was formed with one goal in mind – to be a one stop shop for all tax needs. We understand that many tax issues can arise for taxpayers, especially new ones! Many issues can arise with taxes, including filing taxes, getting extensions, and even help you with audit or any tax liability We are a team of Tax Professionals, CPA’s, Enrolled Agents and Tax Attorneys who can help you with any tax issue that you have. We understand how complicated it can be to get tax help, so we make the process as simple as possible. We explain every step of the processes with our clients, and we make sure to keep them updated as the process moves alone. We assure our clients that they can reach out to us at any time to ask questions. We make complicated processes look like a breeze.

Contact Us:

As a taxpayer, you deserve proper representation. We understand how hard it is to navigate through all the issues that may arise in regards to taxes, which is why we are here to help you. IRS Audit Group will help you file your business taxes on time! Regardless of the specifics, we will be there for you anytime you have an issue relating to your taxes. You can read more about us by visiting our website at irsauditgroup.com. Our office can be reached by email at info@irs-audit-group.com. You can call one of the representatives at our office at (310) 498-7508. You can even drop by one of our beautiful offices. Our Beverly Hills office is located at 468 N Camden Dr, Beverly Hills, CA 90210. Our Newport Beach office is located at 2901 West Coast Hwy, Suite 200, Newport Beach, CA 92663. Contact us today to get the representation you deserve!